How to Series No 4 – How to Account for Hire Purchases

This is the fourth part in a series I’m calling “How-To”. The first part was about insurance bills, the second part was about VicRoads registration bills and the third part was about chattel mortgages. I will be using Xero for the example, but don’t worry if you use another software, the basic rules will still apply.

The fourth how-to is about how to account for hire purchases in your accounting software. A hire purchase arrangement is an agreement to purchase goods in instalments.

Step 1

Let’s pretend that your business has purchased a new printer with all the bells and whistles for $15K via a hire purchase agreement, plus $5,000 interest. For this example, the hire purchase is for 30 months without a residual (balloon) payment at the end of the period. Note, that most hire purchase agreements will include a balloon component (check your documentation). The first thing to do is collect all of the documentation. You will need the hire purchase agreement, the invoice, and the interest amortisation schedule. The hire purchase company will provide all of this to you at the point of purchase. To begin the process, create some accounts in your accounting software:

- Office Equipment (Asset GST Inc)

- Hire Purchase Unexpired Interest (Liability GST Inc)

- Hire Purchase Liability (Liability BAS Excluded)

- Interest Expense – Hire Purchase (Expense BAS Excluded)

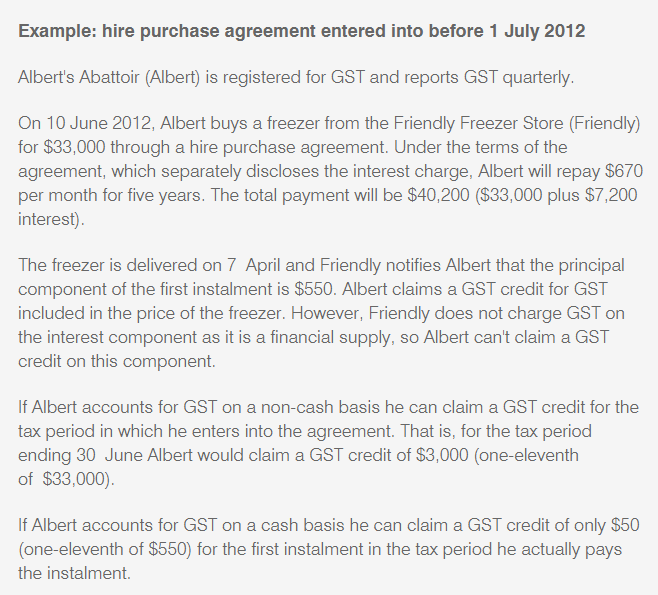

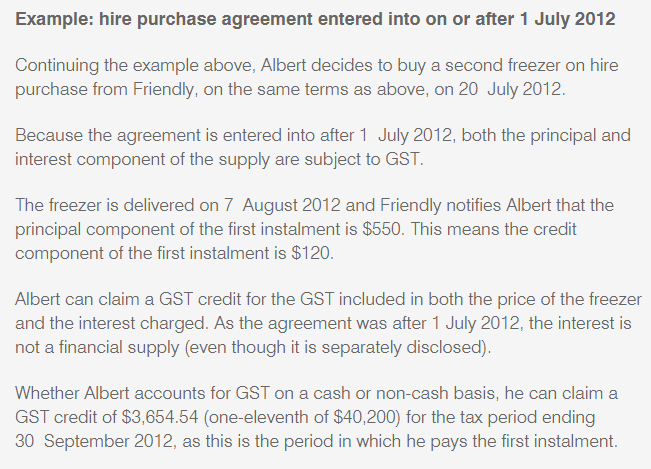

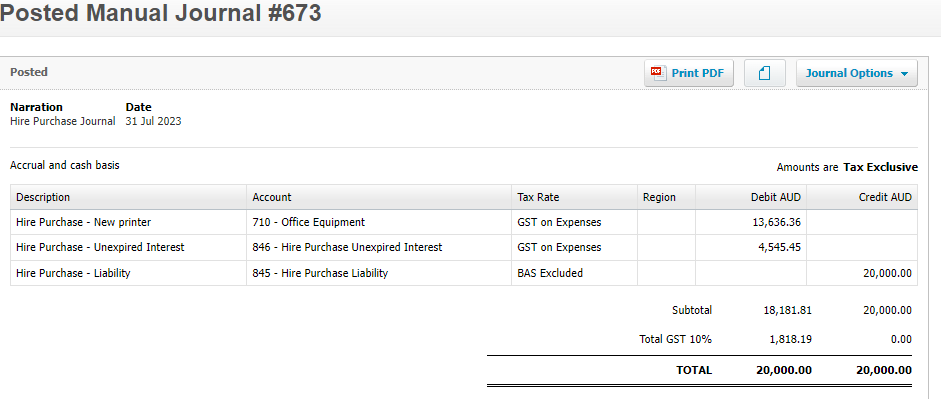

Note, For any Hire Purchase Agreement made after 1/7/2012, both the purchase price of the asset and all interest charges and fees are subject to GST. (see notes at the end of the blog)

Step 2

Now you can enter this journal which adds the purchase of the printer into the accounts:

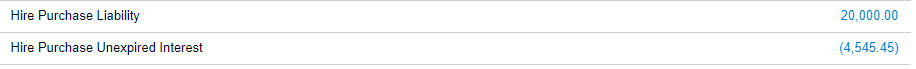

Check your balance sheet. It should look like this:

Step 3

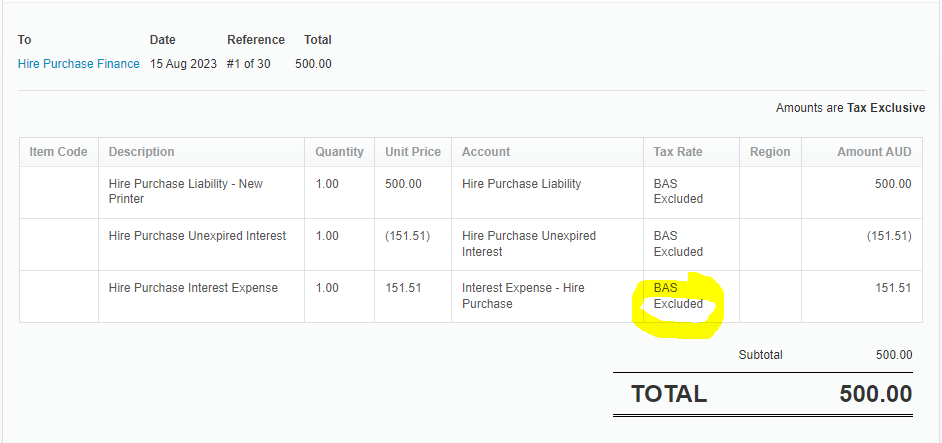

When it comes time to record the first repayment to the finance company, your entry will look like this (assuming each repayment is $500 (30 x $500 = $15K)). Note, that the tax code for the interest expense account is BAS Excluded. This is because the GST on the interest component of the hire purchase was claimed when the purchase was entered initially (see journal). Therefore the monthly repayments of interest are not reportable on the BAS.

Step 4

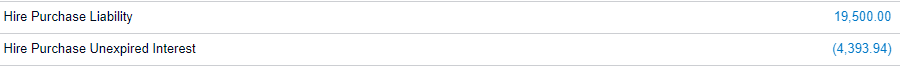

Check that the balances in the balance sheet are reduced by the first repayment – see below. Note that I have evenly split the interest repayments into amounts of $151.51 for this example ($4,545.45 divided by 30 payments). However, you will need to enter the interest amounts as per your amortisation schedule and these won’t be exactly the figures divisible by the number of repayments. Something to keep in mind!

GST rules for hire purchases

For hire purchase agreements entered into on or after 1 July 2012, all components of the transaction are subject to GST including:

• The upfront purchase price of the asset financed under the agreement

• Interest charges, and

• Any other associated fees.

This is the case regardless of whether you account on a cash or accrual basis.

This means that taxpayers on a cash accounting basis can claim the full amount of any available GST credit at the time the first payment is invoiced or paid under the hire purchase.

This was the last part of our How-To series (for now). I hope you found this series useful. For further details about hire purchase agreements and GST, go to this ATO webpage.

How to Series No 4 – How to Account for Hire Purchases Read More »