How to Series No 3 – How to Enter a Chattel Mortgage Asset Purchase & Loan

This is the third part in a series I’m calling “How-To”. The first part was about entering insurance bills and the second part was about how to enter a VicRoads registration bill. I will be using Xero to present the example, but don’t worry if you use another software, the basic rules will still apply.

The third how-to is about how to enter a Chattel Mortgage asset and associated loan into your accounting software.

Step 1

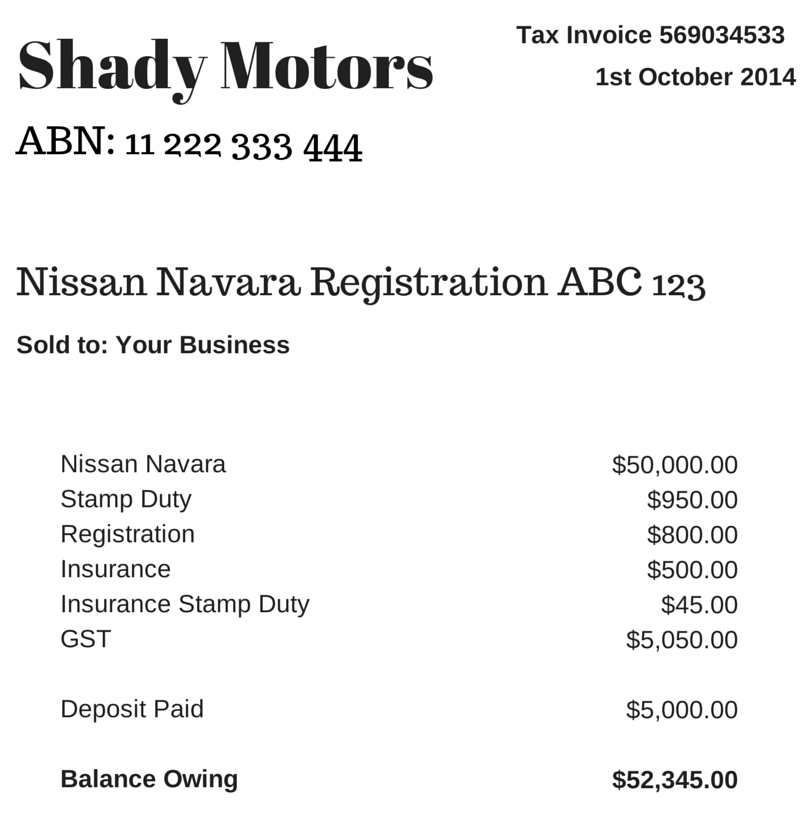

Let’s say your business has purchased a new motor vehicle. The invoice from the vehicle dealer might look something like the below example. Grab your invoice now.

Step 2

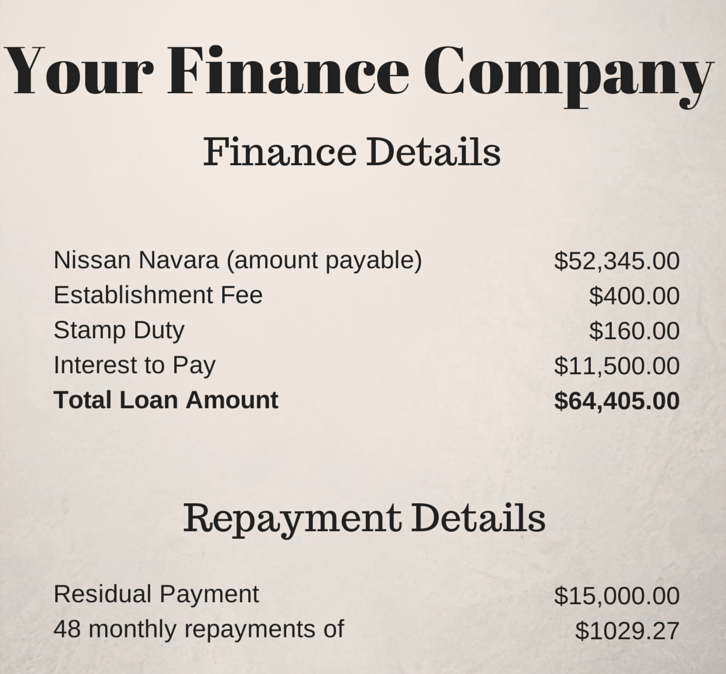

The finance company loan schedule is also required. It may look something like the below example. Grab you loan schedule now.

Step 3

Create the following accounts in your software (check first because some may already exist):

- Deposit Paid (Current Asset) – no tax code

- Motor Vehicles at Cost (Non-Current Asset) – apply capital expense including GST tax code

- Chattel Mortgage (Motor Vehicle) (Non-Current Liability) – no tax code

- Chattel Mortgage Interest Charges (Expense) – no tax code

- Chattel Mortgage Fees & Charges – tax code varies, could be Free or GST inclusive (check your documentation)

- Motor Vehicle Registration (Expense) – apply GST Free tax code

- Motor Vehicle Insurance (Expense) – apply GST inclusive tax code

- Unexpired Term Interest (Non-Current Liability) – no tax code

Step 4

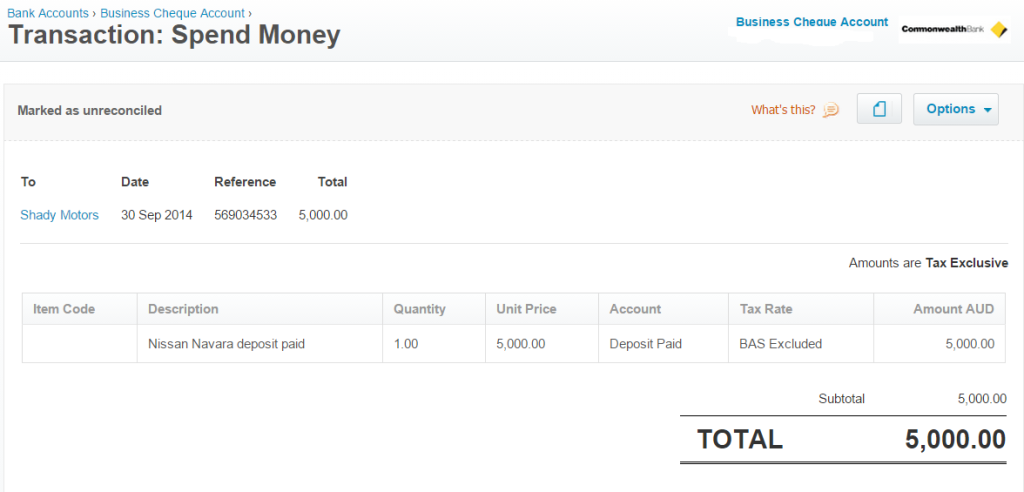

First enter a spend money transaction to record the payment of the deposit:

Step 5

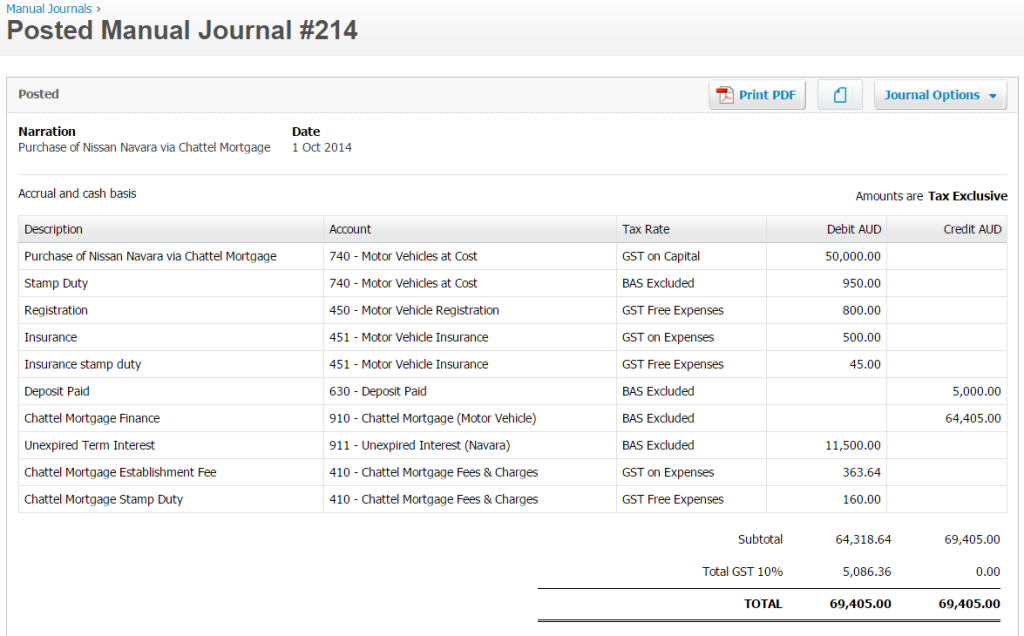

Next, enter this journal to record the purchase of the new vehicle:

Step 6

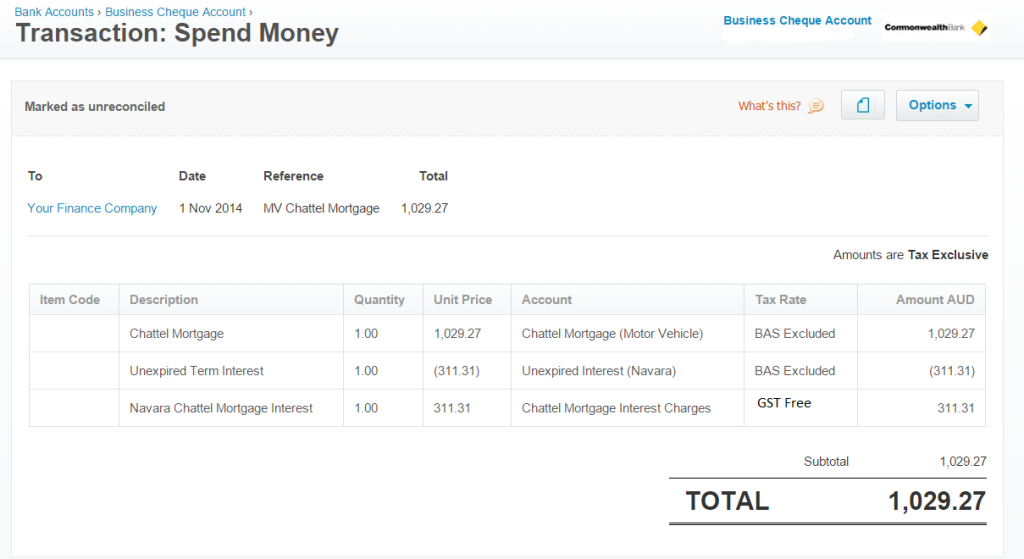

When it comes time to make a repayment to the finance company, enter a spend money transaction like this:

Bonus Tip!

Sometimes it isn’t possible to obtain the loan repayment schedule for whatever reason. When this happens, you need to create your own. I use this amortisation calculator by Bret Whissel. It has served me well over the years. I hope you find it useful too.

Next week for part four of this How-To series, I will cover how to set up a Hire Purchase agreement in your accounts. Until then, happy bookkeeping!

How to Series No 3 – How to Enter a Chattel Mortgage Asset Purchase & Loan Read More »