The “Boosting Cash Flow for Employers” payment (PAYGW Boost Credit)

As part of the economic stimulus triggered by the Corona Virus pandemic, the Federal Government has introduced the “Boosting Cash flow for Employers” measure or as we like to call it, the PAYGW Boost Credit. This measure promises to “refund” the PAYG withholding reported on the BAS or IAS by employers back into their integrated client accounts (ICA) as an offset against any existing BAS/IAS debt. To be clear, this is not a supply of cash to employers into their banks. This is simply crediting PAYGW back into the ICA to effectively reduce BAS/IAS debt. The only time an employer will see any cash is when a refund is created because the PAYGW credit is more than the whole activity statement debt. So who gets these payments, how much do they get and how do they get it? Read on to find out!

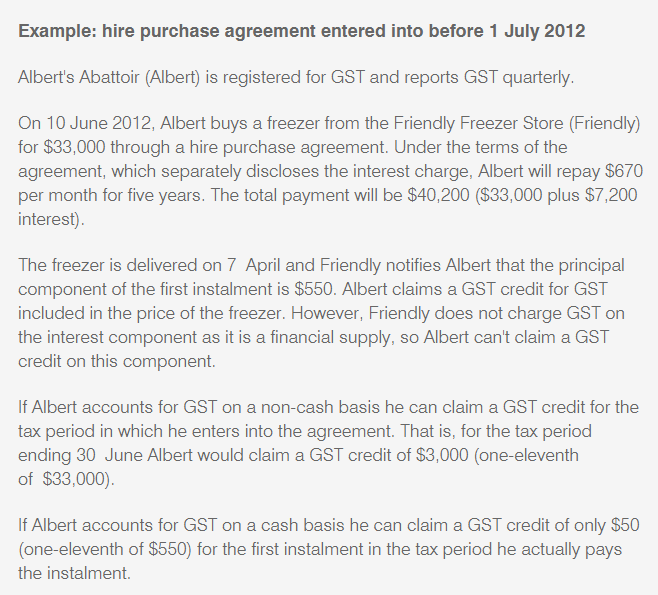

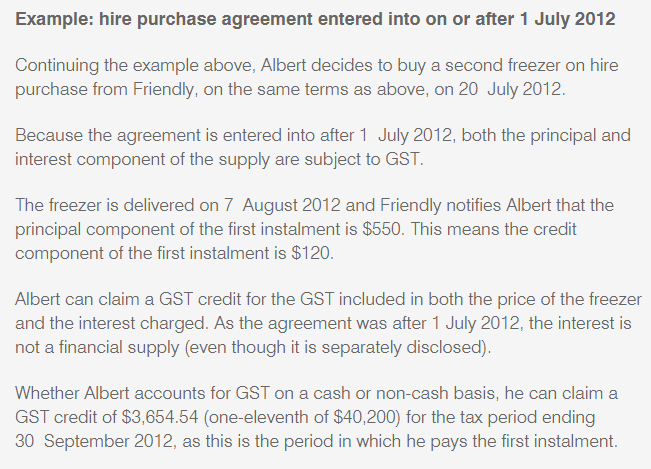

WHO IS ELIGIBLE?

Businesses will be eligible for this stimulus measure if they:

- Held an ABN on 12 March 2020 and continue to be active

- Are a small or medium business including NFP, sole trader, partnership, company and trust entities.

- Have an aggregated turnover under $50M

- Have made payments from which they have been required to withhold (even if this a zero amount). Such payments may include salary and wages, director’s fees, eligible termination payments, compensation payments and withholding from contractor fees.

- Have made GST taxable, GST free or input taxed sales in a previous tax period since 1 July 2018 and lodged a relevant BAS on or before 12 March 2020.

HOW MUCH IS PAID?

PAYG withholding amounts will be credited back to the integrated client account (ICA) of between $20K and $50K. These credits are not income and as such will not be taxed. The do not have to be repaid ever. The good thing is that the PAYG withholding you report on your BAS will still be tax deductible. Note, if you have a tax debt on your ICA, the credit boost amount will simply pay down that debt.

HOW IS IT PAID?

These credits will be applied in two stages to integrated client accounts after 28th April 2020 and after the March 2020 quarter or monthly BAS is lodged. You do not have to apply for this measure, AND you do not receive any actual cash – this is credit only, not cash paid to your bank. The second stage credit will be applied in quarter 1 of 2020-21.

HOW DO THE PAYMENTS WORK?

Put simply, there are 2 payment stages for this measure. The first stage is a payment of up to $50K based on the amount of PAYGW reported on the March 2020 BAS. Examples below:

Quarterly Lodgers

If your March 2020 BAS shows a PAYGW amount of $12,000, this amount will be credited back to your ICA. In your June 2020 BAS, if a $14,000 PAYGW is reported, then this will also be sent back to the ICA. So far, a total of $26,000 has been credited. This is the first stage amount. The second stage amount will be the same as the first one i.e. $26,000 and will be credited to your ICA split evenly across June to September 2020.

Monthly Lodgers

If your March 2020 BAS shows a PAYGW amount of $12,000, this amount is multiplied by 3 (to take up amounts for January and February 2020) to give you a credit of $36,000. April, May and June 2020 BAS’s will continue to be lodged which may or may not total more than $50K. For this example, let’s say April was $10,000, May was $8,000 and June was $6,000. This will be a total PAYGW of $60,000. As the first stage payable can be no more than $50K, then $50K is all that will be credited to your ICA. The second stage payment will also be $50K.

What if my PAYGW is less than $10K or zero in my March 2020 BAS?

In this case, you will be credited $10K in the first stage of credits and another $10K in the second stage for a total of $20K.

PAYGW Boost Credit Calculator

Here is a great calculator to assist you to work out how much your PAYGW boost credit might be: https://digit.business/payg-cashflow-boost-calculator-advanced

The “Boosting Cash Flow for Employers” payment (PAYGW Boost Credit) Read More »