What’s in a GST name?

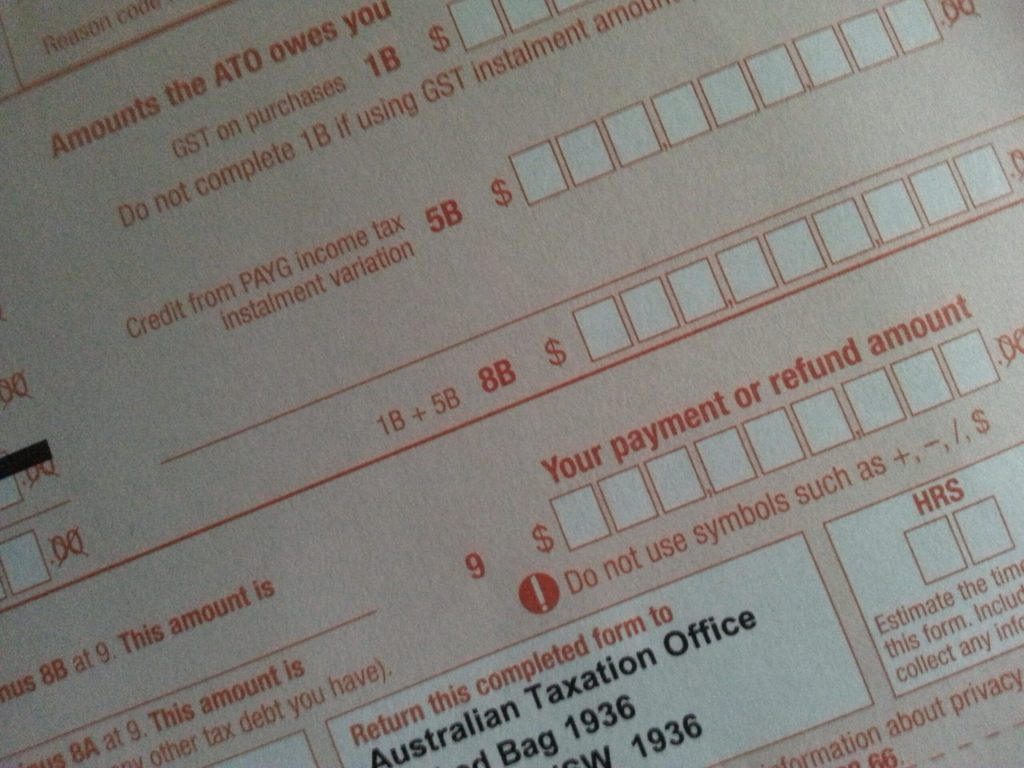

The Goods and Services Tax which we now call “GST” for short, is a complicated and convoluted tax, I’m sure you’ll all agree. The system is fraught with rules with which even the most experienced BAS or Tax Agents struggle to understand. At its core, one of the most difficult aspects of the GST is its own language (yes it has its own language!). The terms used by the ATO to describe even the simplest concept can be confusing and this is why we have supplied a graphic below which explains what some of these terms mean. We hope you find it helpful.

…

What’s in a GST name? Read More »