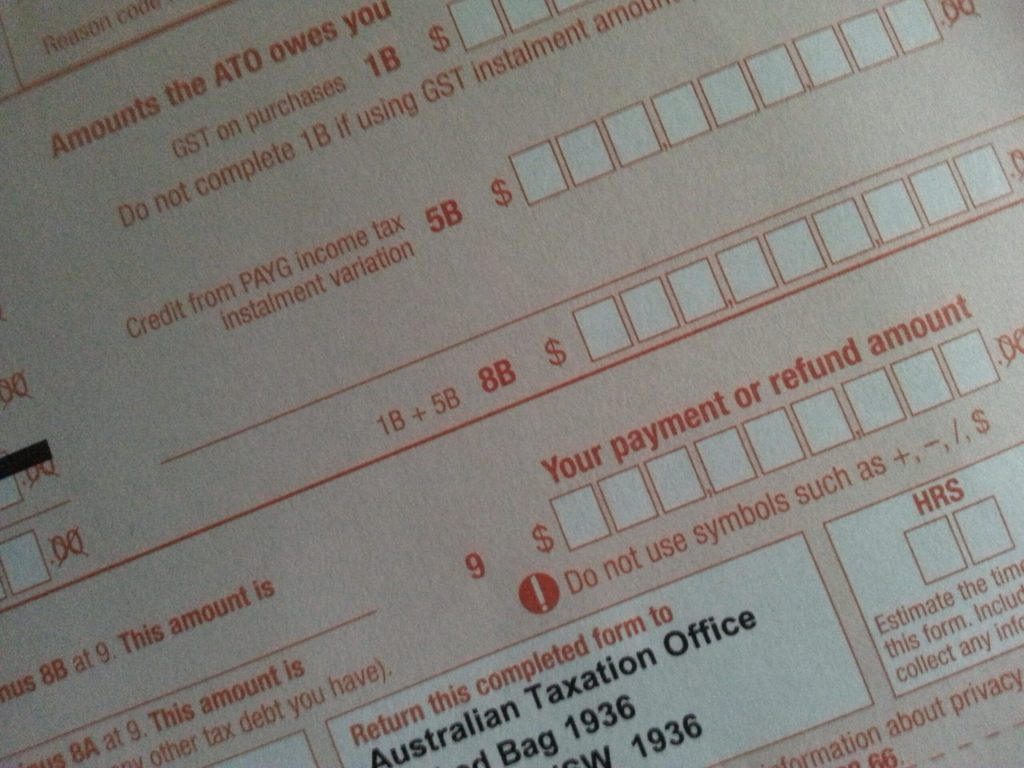

BAS Labels Explained Part 3

This is the final part in a three-part blog series about Business Activity Statement (BAS) labels and what they all mean. You can read part 1 which covers labels for Goods and Services Tax (the “G” labels) and part 2 which looks at PAYG (the “W” labels) in your leisure. Part 3 of the series will showcase BAS labels used to report Fringe Benefits Tax, Luxury Car Tax, Wine Equalisation Tax and Fuel Tax Credits.

…

BAS Labels Explained Part 3 Read More »