This is the third blog in a series about STP Phase 2. The first blog looked at the benefits of STP Phase 2 and the second one outlined which software providers are ready for the changes now. In this blog, we’ll get down and dirty and cover the detail behind STP Phase 2:

What is it?When does it start?What is changing?How payroll is changing and what it will look like - getting technical!

What is STP Phase 2?

Basically, STP Phase 2 is the same as STP Phase 1 except that more payroll data now needs to be reported. STP 2 requires drilling down into the details about your payees, their payments, PAYG withheld, and superannuation. These extra details will be shared with the ATO and Services Australia, providing them with greater visibility about your payees and you, as an employer.

When does STP Phase start?

The start date is 1st January 2022, however, the ATO has issued a blanket deferral to all employers who may not be ready (or their software provider isn’t ready) to the 1st March 2022. See our second blog in this series to see if your software provider has a deferral in place that extends your start date beyond 1st March 2022.

What is changing?

While the overall process of transferring your payroll data to the ATO via STP is not changing, there are some specific attributes of the process that will change. These are listed below:

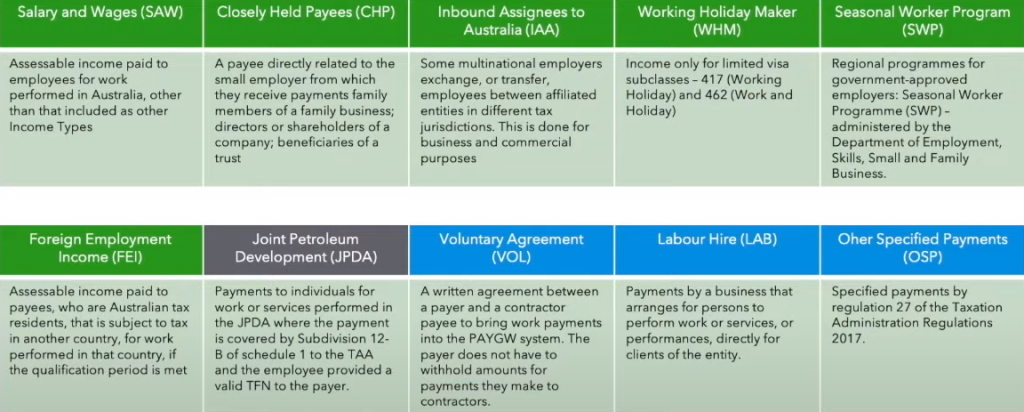

Reporting of income types and country codes - see graphic below.Disaggregation of gross income - you will be required to report more detail about income including gross, allowances, paid leave, overtime, bonuses and commissions, directors' fees and salary sacrifice.New fields to replace Tax File Number Declaration services - while you will still need to retain a copy of the employee's TFND, you will no longer be required to send a copy to the ATO as data relating to the TFND will be transmitted at each and every pay event.Lump Sum E by financial year - If you need to make a Lump Sum E payment (back payments more than 12 months old), you won't need to provide a Lump Sum E letter to your employee as it will be included in the STP report.Adding new cessation type reason - because the date and reason for employment cessation will be in the STP report, you will no longer need to complete and provide separation certificates to employees.New Child Support Agency deduction and garnishee–Child Support deductions and/or garnishees will be reported via STP reducing the need for you to send separate remittance advice to the Child Support Registrar.Transferring payee year-to-date amounts–if you change software type or an employee's payroll ID number, this will be reported via the STP report. This will help avoid duplicate income statements appearing in employees' myGov accounts.Separately reporting salary sacrifice - you will be required to report the pre-sacrificed income as well as the amount of salary sacrifice.

What will payroll look like under STP Phase 2?

As you can see from the list above, the types of data you will report via STP 2 will change. Specifically, there is more data required than that reported via STP Phase 1. In order to report this extra data, your payroll needs to be set up correctly. There will be new income types (see above) and new STP codes used by the ATO to read your data. The income types (both old and new) will need to be mapped to these new STP codes. Further to this, each employee setup will require some review/checking and new fields populated, including tax treatment codes and/or country codes (see below link). (Our next blog will provide you with a spreadsheet you can use to gather the information you will need for each of your employees before you set up STP Phase 2 in your software.)

Our main message to you is “do not panic”! Your software provider will assist you with the move to STP 2 when the time comes. In the meantime, we suggest that you do some research to assist you in better understanding how your payroll will be affected by STP Phase 2. To help you with this, we have created the below table. There are links to relevant ATO web pages which will provide specific information about how STP 2 relates to your employees, their payments, and tax withheld from those payments.

In our next blog in this series, we will tell you how you can get ready for STP 2 Phase 2, even if your software provider hasn’t begun to roll it out.

Pingback: Is your software provider ready for STP Phase 2 now? — e-BAS Accounts

Pingback: Transitioning to STP Phase 2 - Planning Ahead — e-BAS Accounts