In an attempt to protect and improve workers’ retirement savings, the Government announced super reforms “Your Future, Your Super”. This was passed into law on the 24th of June 2021.

As part of these new laws, how you, as an employer, deal with new employees’ super funds and subsequent payment into those funds, has changed.

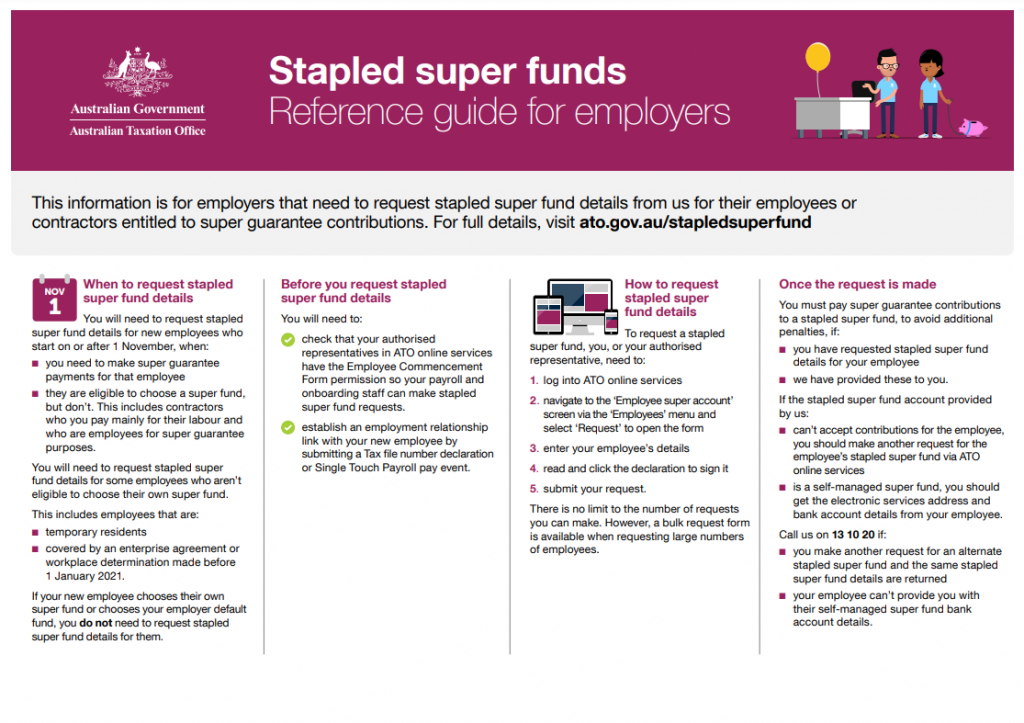

From 1st November 2021, when a new employee starts working for you, you must pay their super into their “Stapled Super Fund” if he/she does not provide you with a choice of fund.

What is a Stapled Super Fund (SSF)?

An SSF is an existing super account that is linked or “stapled” to an employee so that it follows him/her around when he/she changes jobs.

Why do we need Stapled Super Funds?

In the past, it was common for employees to end up with multiple super accounts, especially when employers paid super into their default super funds. Having multiple accounts means that employees are unwittingly paying fees from each account which can add up to a lot of lost retirement savings. From the ATO, “the change aims to reduce account fees by stopping new super accounts being opened each time an employee starts a new job”.

How do you know when you need to use a SSF and how do you do it?

Currently, when a new employee starts working for you, you must provide him/her with a Super Standard Choice Form to complete. The form will provide you with the employee’s super details. If the employee fails to provide these details to you, you must then find out what his/her SSF is and pay super into that fund.

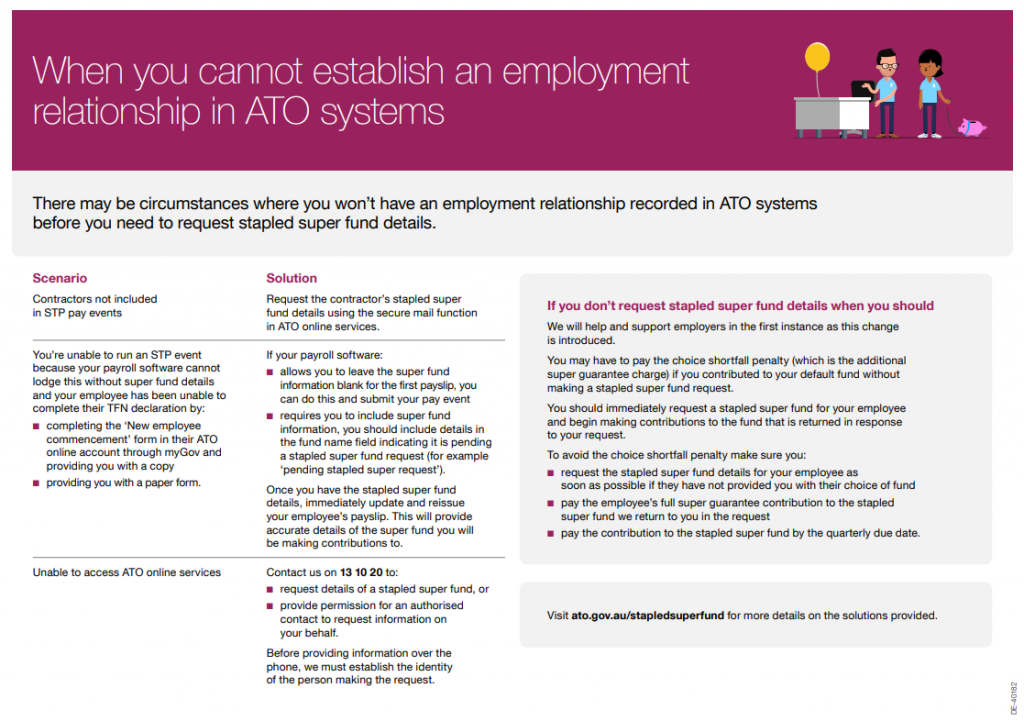

A request for an SSF for your employee is done via Online services for Business (or your Tax/BAS Agent can do it for you). If you cannot access Online Services, you can ring the ATO on 13 10 20 to make the request. When you log into your online account, go to the Business tab, then Employee Super Accounts, then click on “request”. Follow the prompts and you will be provided with the SSF within minutes.

Please note, that you will not be able to make an SSF request until the ATO has confirmed that you are the employee’s employer. This is done via either them receiving the Tax File Number Declaration details or by an STP lodgement event.

How is a SSF determined by the ATO?

The ATO will find the fund that has had the most recent contribution paid into it. This will become the employee’s SSF.

What if a SSF is not provided by the ATO?

If this happens and your employee has still not provided his/her super details, you may make payments into your default super fund.

What happens if the SSF rejects the payment?

If this happens, the ATO recommends that you make another request. If the same SSF is provided, then you must call the ATO on 13 10 20 for assistance.

Is there a transition period?

Yes! The ATO is providing a transition period. This will be between 01/11/2021 and 31/10/2022. After this period has ended, the ATO may apply penalties should you fail to comply with the Stapled Super Fund rules.

Summary – see our infographic below (free to download)

Stapled Super Funds begin on 1st November, 2021.Only request SSF for employees who do not provide their super details to you.SSF requests are done via Online Services for Business or your Tax/BAS Agent can make the requests on your behalf.If an SSF does not exist, you may make super payments for the employee into your default super fund.

Need more help? Here are 2 reference guides from the ATO