This excerpt is taken from the ATO website via this link.

Have you taken on new employees? Did you know they can complete a TFN declaration through ATO online services?

This is an easy way for them to provide both you and us with the information we need. If your new employee has a myGov account linked to the ATO, they can:

- access ATO online services

- go to the ‘Employment’ menu

- select ‘New employment’ and complete the form.

This sends the TFN declaration details straight to us so you don’t have to. Your employee will need your ABN to complete the form. Once they’ve submitted the form, they need to print it and give you the summary of their tax details so you can input the data into your system.

You may be able to link your payroll software to the online commencement forms. But check first with your software provider if they offer this service.

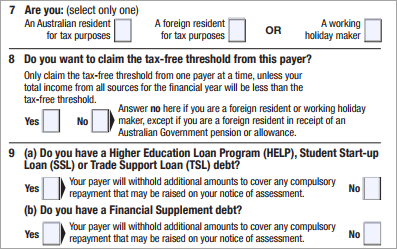

You can also use the New employment form to collect a range of information. Despite its name, you can also use this form instead of the:

- Withholding declaration form

- Medicare levy variation declaration form

- Superannuation standard choice form.

Your employees can use the New employment form to update their tax circumstances with you, for example, if:

- their residency status has changed

- they no longer have a government study and training loan

- they are claiming the tax-free threshold from a different employer.

You can continue to use your current processes, including providing a paper TFN declaration where employees can’t create a myGov account or don’t have access to the internet.