The bookkeeping behind the Taxable Payments Annual Report

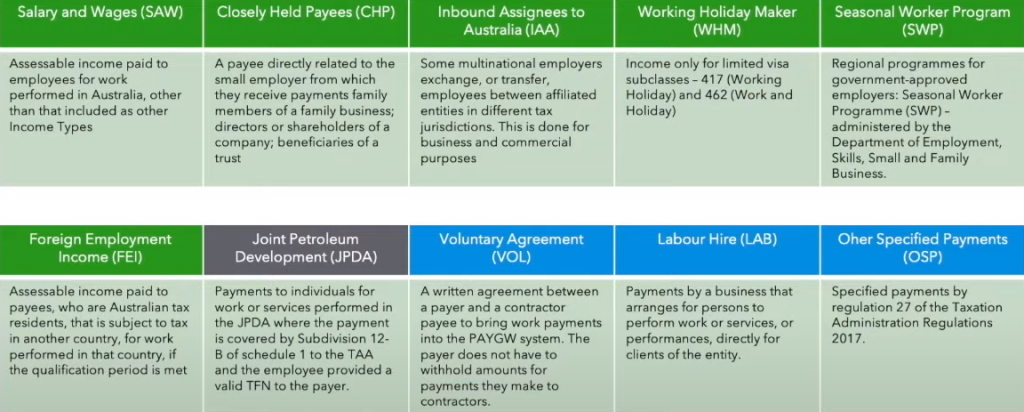

There is a lot of information available to you if you just want to understand what a Taxable Payments Annual Report (TPAR) is and why you may need to lodge one. In short, if your business is primarily in one of the below industries and has made payments to contractors in the previous financial year, then a TPAR will need to be prepared and lodged.

Building and construction servicesCleaning servicesRoad freight and courier servicesInformation technology servicesSecurity, investigation or surveillance services

If you are new to the TPAR, then I suggest you go to this ATO webpage and have a read!

So, as I said, there is a lot of information you can Google about TPAR in general, but not a whole lot about how to prepare the report from a bookkeeping point of view. Some software will have you believe that you just select a few boxes here and there and then submit the report to the ATO. Voila! Done. Easy. Well, it is easy if you didn’t actually pay contractors in a given year, but if you did, there are a few steps you need to take to ensure your report is true and correct. In this blog, I will share my process for preparing the TPAR for my clients. I hope this helps you if you are feeling a bit lost as to the “how” behind the “what”!

How to prepare your TPAR in 6 easy steps

1. Make a list of contractors

Before you can prepare the TPAR, especially if this is the first time you have done this, you should make a list of all of the contractors you have paid during the financial year. Now move on to step 2.

2. Check contractor Details

The TPAR requires that you report various personal details about your contractors including the full name of the contact person, business name, business address, email address, phone number and the ABN. Before you begin preparing the TPAR, go through your contractor list and make sure these details have been added to their contact cards.

3. Ensure contractors are selected to be part of the TPAR

In your software, each contact card will have a checkbox to select if the contractor needs to be reported on the TPAR. Go through each contractor’s contact card and ensure this is selected if required.

4. Print out the TPAR and check the details

Find the TPAR in your software. At this point, it is only a draft report. Print it out and review each transaction – check that all transactions should be included. Remember, only invoices for labour and materials or just labour, need to be included. Invoices for materials-only do not need to be included. Materials-only invoices will need to be manually removed but clicking into the transaction and deselecting the checkbox for TPAR. If you have made any changes to the draft TPAR, then print out the updated version and move on to step 4!

5. Ensure the TPAR agrees with your profit and loss data

This is where some bookkeeping comes in! Not everyone knows that you need to make sure the total amount quoted in the TPAR agrees with the data reported on your profit and loss. This is called reconciliation. If you don’t do this step, your TPAR may be incorrect, so it’s pretty important! The TPAR only includes payments you made to contractors within a financial year – unpaid invoices are not included. Therefore, in order to perform this reconciliation, you need to print out the profit and loss in cash mode. Now, depending on how many transactions there are, you can either compare the two reports by eye or if you need to, you can export the profit and loss data to a spreadsheet to help you compare the calculations. Note, that the profit and loss data required will be where you recorded your contractor payments. This may be an expense account or a cost of sales account, depending on how your chart of accounts is set up.

Now, you need to ensure that the total amount showing in your TPAR, less the GST, agrees with the profit and loss data. If your initial setup was correct, these two reports should agree. If they don’t, there may be a couple of reasons why. Here are some things to check:

1) Make sure that all contractor transactions in the TPAR also appear in the P&L and vice versa. This may involve checking that those particular transactions have the TPAR checkbox selected or that you have a contractor’s contact card selected for TPAR. 2) If you have included some materials-only transactions in either the P&L data or TPAR, you must remove them. 3) You may also find that some transactions have been coded to other expense accounts and are therefore not included in the P&L data you initially exported or printed. Find those transactions and add them to your exported data.

When you are satisfied that the two reports agree, then print out a final TPAR and save it as a PDF for your records.

6. Lodge the TPAR

Depending on the software you are using, you may be able to lodge the TPAR within the software itself. If not, you will have to download a TPAR file and lodge it with the ATO using Online Services and/or your myGov account. Find more details here about how to lodge via ATO Online Services. Keep a record of the lodgement receipt you will receive from the ATO with your TPAR from your software.

Remember, if you do not have any contractor payments to report, you need to report a Non Lodgement Advice form. See my blog here for more information.

So that’s all there is to it, but as you can see, lodging the TPAR does require some background work. You can’t just click a button and lodge it because you need to ensure the figures and the data are correct. I hope this blog has helped you in the run-up to the TPAR lodgement due date which is August 28th each year. If you need help preparing your TPAR, please don’t hesitate to get in touch with me and I’ll see if I can assist you.

The bookkeeping behind the Taxable Payments Annual Report Read More »