With all of the web content being thrown at us daily via email and social media, it’s hard to know what’s worth reading and what’s just rubbish! If you’re a busy business owner like me, you can’t read everything, there’s just not enough time in the day. However, as a business owner, you also know that there is information out there that you should be across, particularly in relation to taxation, GST and employing. Most of this information can be found on the Australian Taxation Office website, but again, there is a mountain of data to read there, so where do you start? To save you time, I have compiled a list of ATO links I believe will be the most useful for business owners. Take a read through and bookmark the links of interest to you.

1. ATO YouTube channel – ato.gov.au

1. ATO YouTube channel – ato.gov.au

The ATO has it’s own YouTube channel which contains several videos about taxation, GST, running your business, BAS and lots more!

2. Small business newsroom | Small Business Newsroom

There are 2 newsletters to which you can subscribe that regularly provide information about employment issues, GST, Superannation, lodging and paying tax, fringe benefits tax and other general tax advice. The “Small Business Newsroom” is specifically for small business owners while the “Business Bulletins” is directed at medium to large businesses.

3. Small business support | After hours web chat | Contact ATO by phone

Need to discuss a taxation issue with the ATO but you’re just too busy during the day? No matter, you can now book an after hours call via the above link. Once booked, a consultant will call you back at the time you specified – a great service! For those who prefer not to talk via telephone, there is also a web chat service. I have also provided the link to telephone numbers you can call during the day if the other 2 options don’t suit you.

4. Order forms and other documents

From time to time, you may need quick access to taxation booklets, forms or other information. One of the best ways to obtain this information is by ordering it online from the ATO. The information will be sent you either via post or email depending on the product.

5. Online services

The ATO has provided the ability for business owners to connect with the ATO electronically for several years now. Business owners can log into their business portal and lodge their own BAS and other forms and can correspond securely with the ATO as required. I highly recommend that all business owners review their options in this space as the ATO is moving further and further towards online platforms and those who ignore this will get left behind. The link above provides more information about this topic.

6. 24 hour self-help services

This service allows you to call the ATO whenever you like to do any of the following:

- Set up a payment arrangement

- Lodge a nil activity statement

- Verify an ABN

- Register for fuel tax credits

- and much more!

7. Search – sort by topic | Small business assist

Need to find some taxation information quickly? These 2 links may help. “Search” is an alphabetical listing of various topics while “Small business assist” is a service where by you type in your question and a range of websites and pages will be provided related to the information you require.

8. Dates for current financial year

Not sure when your BAS is due or when you need to pay your employees’ superannuation? This link will help – it’s a list of current key tax lodgement due dates for this financial year.

9. For Employers!

Here is a group of links for those of you who are employers or who are about to employ staff. They include information on employing for the first time, PAYG withholding (what it is and how it works), a tax withholding calculator, the log-on page to the super clearing house and the super guarantee charge statement and calculator tool (for those who have missed the quarterly super payment due date).

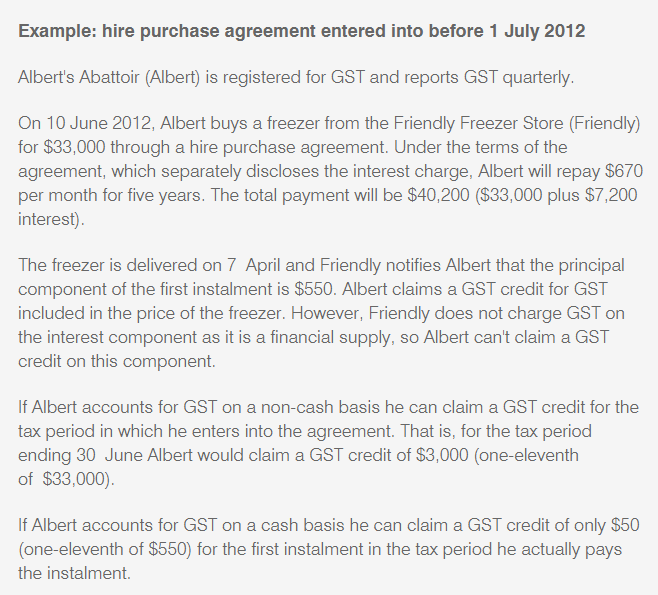

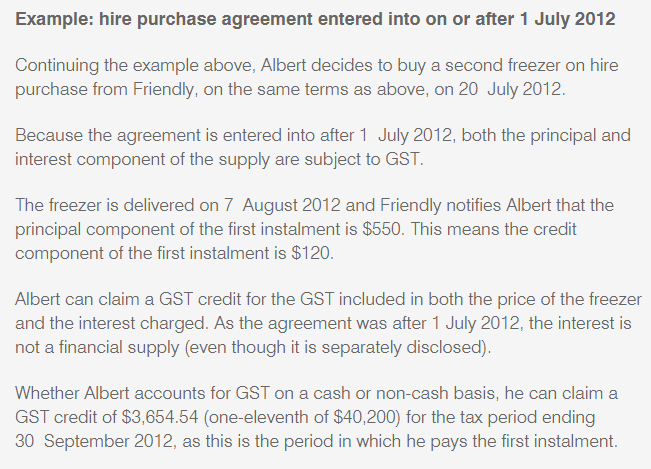

10. How the GST works | Claiming business deductions | Home office expenses calculator | Selling or closing your business

This group of links relate to general taxation information about topics and issues that business owners may find useful, especially the business deductions link.

11. Difficulty paying

Having trouble paying tax debt? This link provides information about how to handle this situation.

I hope this list of useful ATO links will prove helpful to you as a business owner. You could bookmark them all or simply bookmark this blog so you can access all links with one click!

As a business owner, do you find yourself using particular ATO web pages all the time? If they aren’t already listed here, please share your links below – they may just help someone else 🙂