A Better Employee Onboarding Experience is coming…

The way new employees are onboarded is changing. Currently, employers ask new employees to provide a Tax File Number Declaration form, a Super Choice form, and also other personal information required in order to set them up in their payroll systems.

While this process is fairly straightforward, often employers find themselves chasing new employees for the data and at times, needing to confirm details that may or may not be correct (usually not correct in my experience!). This process can therefore be very time-consuming and tedious for employers, not to mention that the room for error is very high. It is also not a great deal of fun for new employees either!

Enter the “New Employment Form”.

This is an all-in-one onboarding form that new employees access from their myGov accounts. The form will provide both the ATO and the employer with all of the information required to set up new employees in one easy action.

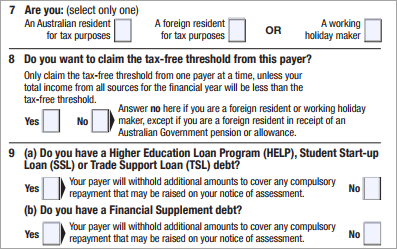

Importantly, this form will replace several forms. These include the Tax File Number Declaration, the Super Choice form, the Variation to Tax Withholding Declaration, the Variation to Medicare Levy Declaration, etc. Employees can also use it to update their tax circumstances, for example, if:

- their residency status has changed

- they no longer have a government study and training loan

- they are claiming the tax-free threshold from a different employer.

This change to employee onboarding will reduce the administrative burden for employers and increase process efficiencies. It will also reduce data recording errors which are very common when obtaining personal details from new staff members.

How the new onboarding process works

Firstly, the employer needs to provide his/her ABN to the new employees.

To access the new form, employees will require a myGov account linked to the ATO. Once signed in they will:

- access ATO online services

- go to the ‘Employment’ menu

- select ‘New employment’ and

- complete the form then

- submit the form

After submitting the form, the details will be sent straight to the ATO removing the requirement for employers to send completed TFN Declarations separately. It’s important to note that the changes to Single Touch Payroll Phase 2 have also made this possible i.e. every time a pay run is reported via STP 2, employees’ tax information is sent to the ATO. Although this step can now be removed from the onboarding process, employers must continue to receive completed TFN Declarations from new employees and retain them as part of the employees’ records.

Once the form is submitted, the employee will print the form and give it to the employer who will use the information to set up the employee in the payroll system.

It’s important to note that the downloadable version of the TFN declaration form will be removed by the end of 2022.

The ATO is therefore requiring new employees to be onboarded using the new above process going forward. This is a new process that both employers and employees need to understand and adopt. It has benefits in terms of efficiency and data security and in my opinion, is the way forward.

A Better Employee Onboarding Experience is coming… Read More »