Last week’s blog was all about Chattel Mortgages, what they are and how to account for them in your general ledger. This week I am going to cover Hire Purchase agreements and especially how GST relates to them. A Hire Purchase agreement is a financial contract that allows the buyer to pay for goods over a certain period of time rather than paying the full amount upfront. Hire purchase agreements allow the buyer to:

- Pay for the goods via instalments over an agreed amount of time

- Use the goods while still paying for them

- Take ownership of the goods once the final payment is received by the lender

Regarding GST and Hire purchase agreements, there are differences in the way in which it is accounted for depending on the date the Hire Purchase was established.

Before 1 July 2012

Hire Purchase agreements are composed of both principal and interest components. Before 1 July 2012, if the lender did not disclose the interest component amount to the buyer, then GST was applied to the total cost of the agreement. If, however, the lender did disclose the interest figure, then GST was only applied to the principle component. In terms of accounting for GST, how much and when you can claim is dependent on if you account for GST on a cash or accrual basis. If you account via the accrual basis, then you may claim the full amount of GST charged on the agreement when you either make the first payment or receive a tax invoice. Those who account via the cash method may only claim the GST paid on the principal component of each instalment in the period in which it is paid.

After 1 July 2012

After this date, all components of a new Hire Purchase agreement, including the principal, interest and any other fees and charges are taxable i.e. include GST, whether or not the lender discloses the interest component. All buyers, regardless of whether they account for GST via the accrual or cash method, can claim the full amount of the GST charged either when the first payment is made or a tax invoice is received.

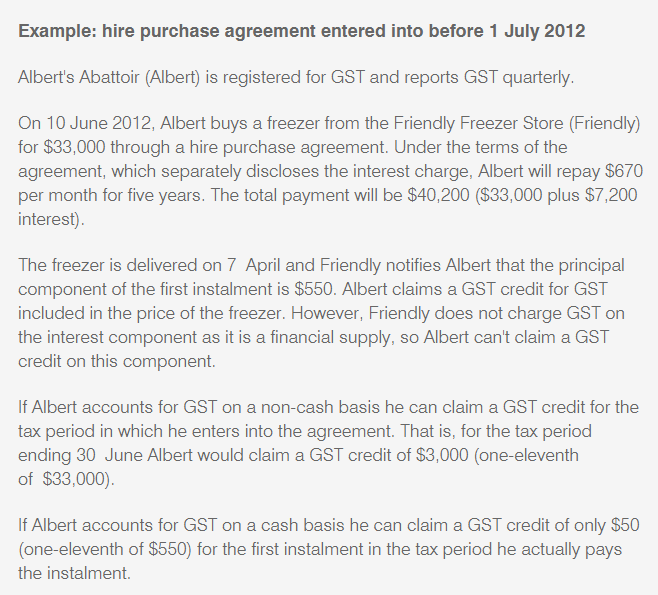

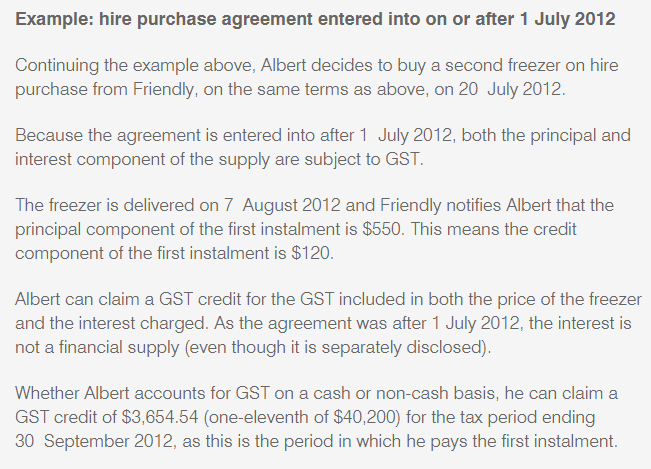

Here are some examples provided by the ATO regarding how to account for GST for a Hire Purchase agreement:

Hire Purchase agreement entered into BEFORE 1 July 2012

Hire Purchase agreement entered into AFTER 1 July 2012