Simple Cash Flow Tool

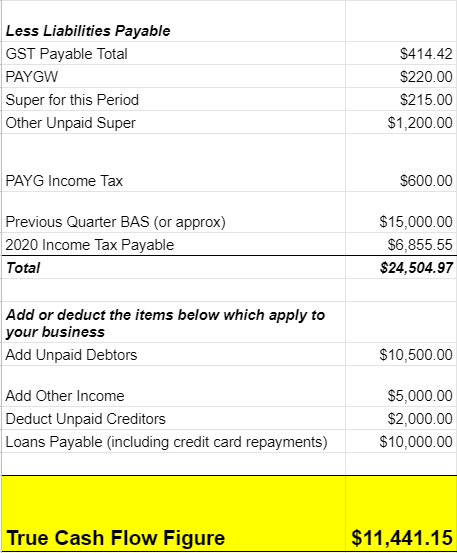

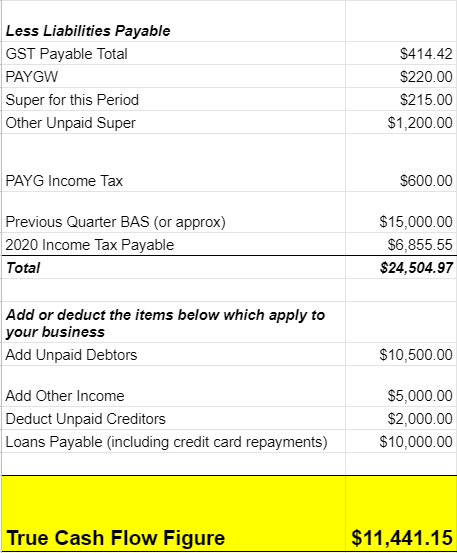

In this blog, I am going to share a cash flow spreadsheet that I use in my business. This is my very “simple cash flow

Welcome to our bookkeeping blog! We share bookkeeping tips, software updates and the latest news from the ATO. Sometimes we get a bit cheeky and let you know what we really think about this industry, but we try to behave ourselves most of the time! Enjoy the read and if you’re looking for anything in particular, hit the search button above.

In this blog, I am going to share a cash flow spreadsheet that I use in my business. This is my very “simple cash flow

This year we are making some changes to our internal processes. As part of those changes, we recently moved to a new job management system called Clickup.

Employers now have more incentive to employ workers under 35! The JobMaker Hiring credit legislation has now been passed into law! This credit was part of the 2020-21 Budget, which will operate until 6 October 2022. It is designed to improve the prospects of young individuals getting employment following the devastating impact of COVID-19 on the labour market.

A new legislative instrument has been released which has extended the services BAS Agents can provide to clients in relation to the super guarantee charge. BAS Agents have been able to assist clients with superannuation tasks for approximately 2 years now, but this instrument improves on the current situation.

This measure promises to “refund” the PAYG withholding reported on the BAS or IAS by employers back into their integrated client accounts (ICA) as an offset against any existing BAS/IAS debt. To be clear, this is not a supply of cash to employers into their banks.

The JobSeeker payment will be delivered by Centrelink, now known as Services Australia. It is a new payment designed to assist those who have lost

During the Corona Virus pandemic, the following states have decided to either waive or defer payments of payroll tax. See below for further information. VICTORIA

Coronavirus (COVID-19) has brought with it great uncertainty and worry amongst the general population, not the least of these, employers and staff.