A Better Employee Onboarding Experience is coming…

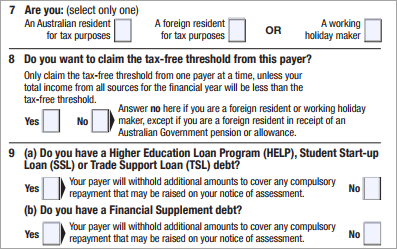

The way new employees are onboarded is changing. Enter the “New Employment Form”. This is an all-in-one onboarding form that new employees access from their myGov accounts. The form will provide both the ATO and the employer with all of the information required to set up new employees in one easy action.