29 Common GST Mistakes

Even though the Goods and Services Tax (GST) has been in operation for more than 20 years, despite its best efforts to educate the general

Welcome to our bookkeeping blog! We share bookkeeping tips, software updates and the latest news from the ATO. Sometimes we get a bit cheeky and let you know what we really think about this industry, but we try to behave ourselves most of the time! Enjoy the read and if you’re looking for anything in particular, hit the search button above.

Even though the Goods and Services Tax (GST) has been in operation for more than 20 years, despite its best efforts to educate the general

It’s a well known fact that almost everyone can prepare and lodge the Business Activity Statement (BAS). Those who charge a fee for this task

One of the things I like to do once the Christmas festivities are over and the new year has been rung in is to take

In our last blog, we told you about our new paperless bookkeeping system that we now use for our own bookkeeping/accounting. It works so well

Starting this financial year 2013-14, we’ve decided to go paperless! We’re changing our own bookkeeping processes and also how we keep our clients’ records. In

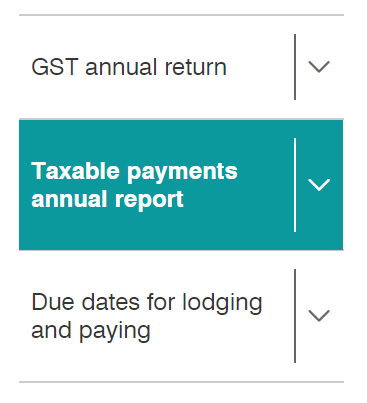

If you are in the building and construction industry, you are now required to lodge a taxable payments annual report (TPAR) by the 28th of

As of 30 June 2013, the Tax Agent Services Act 2009 (TASA) has been amended. What parts of the legislation have been amended and how

The Tax Agent Services Act 2009 (TASA 2009) together with two other pieces of legislation known as “Regulations” and “Transitional Rules” make up the legislation

We’ve been running our bookkeeping business for over 10 years and in that time we’ve worked with many different clients; some have been wonderful and