In our last 2 blogs, we explored the chart of accounts. We looked at the accounts within the chart in detail and explained that each account has a special part to play within the profit and loss report and the balance sheet. This week we thought it would be a good idea to review balance sheets, what they are, what they look like and how you can use them to better understand what is happening behind the scenes in your business. Next week, we do the same thing with the profit and loss report.

What is a balance sheet?

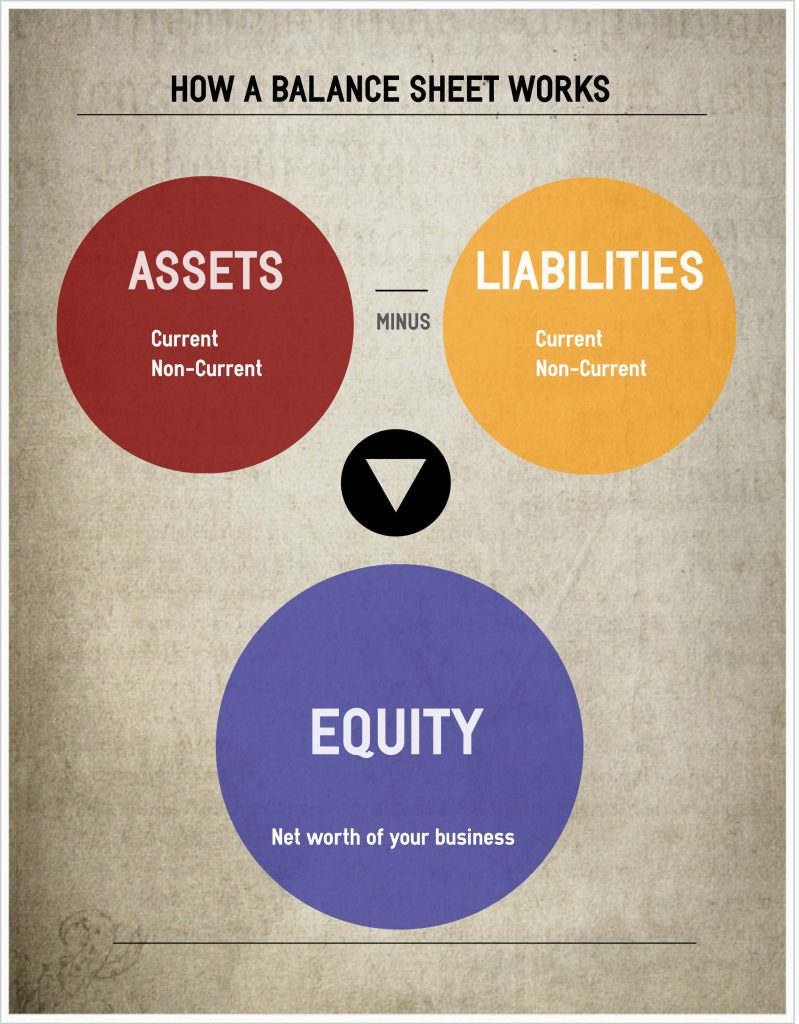

The balance sheet is a report about a business’s financial health. Basically, it provides information about what the business owns (assets) and how much the business owes to others (liabilities). The difference between these two facets is the net worth of the business at a particular point in time. This infographic explains this concept:

What does a balance sheet look like?

The balance sheet is divided into 3 parts: Assets, Liabilities and Equity. As the infographic above shows, the assets minus the liabilities equals the equity – this is why it’s called a balance sheet i.e. the equity must balance with the difference between assets and liabilities. The infographic below shows what a basic balance sheet looks like:

How can a balance sheet help my business?

The balance sheet is a very useful tool and shouldn’t be overlooked by business owners. Of course it is only going to be of value if the bookkeeping is up to date – there isn’t any point in looking at figures that are month’s old or aren’t accurate. A good bookkeeper will help you keep your figures current and correct. The balance sheet provides you with some very important data at a glance. In terms of what you own (assets), a balance sheet will tell you how much is in your bank/s, how much customers owe you (accounts receivable) and the value of your non-current assets such as vehicles and buildings, less depreciation. In terms of liabilities, the balance sheet will tell you how much you owe to suppliers (accounts payable), how much is outstanding on loans and credit cards and how much is owed to the ATO. Armed with this information, you can make proactive decisions that will ultimately benefit your business e.g. contact debtors for payment, work out when/if you can pay debts (and how much), make plans to buy equipment etc. An accurate balance sheet can also be used when applying for bank loans or attracting the interest of investors which is important if you are wanting to expand. Lastly, all public companies and large proprietary companies are required by law to prepare a balance sheet as part of their formal annual financial report. This is usually done by your accountant.

In summary, the balance sheet is a report that helps the business owner

- see at a glance how his business is tracking

- make informed day-to-day financial decisions

- apply for loans and attract investors

- comply with the law (if public or proprietary company)

In next week’s blog, we will explore the ins and outs of the profit and loss report. Until then, happy bookkeeping!

Very Informative Article. Really earned quality knowledge! Thanks for sharing this valuable information.

Great post keep posting thank you!!