Non-compliant Small Businesses to Face Monthly BAS Reporting

If you’re a small business who continues to deliberately disregard your obligations, you can expect the ATO to move you to more frequent GST reporting (Will Day, ATO)

Welcome to our bookkeeping blog! We share bookkeeping tips, software updates and the latest news from the ATO. Sometimes we get a bit cheeky and let you know what we really think about this industry, but we try to behave ourselves most of the time! Enjoy the read and if you’re looking for anything in particular, hit the search button above.

If you’re a small business who continues to deliberately disregard your obligations, you can expect the ATO to move you to more frequent GST reporting (Will Day, ATO)

What you may not know is that from 1 July 2026, the ATO Small Business Super Clearing House (SBSCH) will close. Yes, you heard right—it is closing its doors at the same time as Payday Super begins.

The government has decided to pay super guarantee equivalent payments on government-funded Paid Parental Leave (PPL). This will begin from 1st July 2025

Xero users who use the payroll function will be pleased to hear that an update has been released whereby failed or returned super payments can

On Monday 26th August 2024, changes to casual employment laws came into effect. The changes include a new definition of a casual employee and a new pathway for employees to convert from casual to permanent employment.

The ATO has set up a website to help small business owners learn about running their businesses. It’s called Essentials to Strengthen your Small Business.

Cannot link to your new tax agent? The problem may be outdated ABN Details.

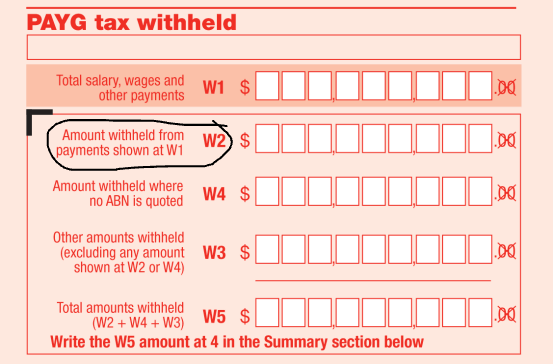

If you’re an employer, your PAYG withholding (PAYGWH) cycle might change depending on how much you withheld in the prior financial year.

In this blog, I will share some useful links, videos and phone numbers to help those stumbling through the Client Agent Linking process.