|

Getting your Trinity Audio player ready...

|

This week, I am starting a bookkeeping resource series called “How To” (not very original, I know!). Each week I will share instructions with you about how to enter some common transactions. I will be using Xero to present the example, but don’t worry if you use another software, the basic rules will still apply.

So here goes, the first how-to is about how to enter an insurance bill into your accounts the right way.

Step 1

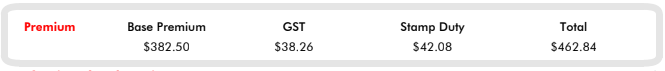

Grab your insurance bill and go to the part where it shows you the breakdown of charges. It may look something like this:

Step 2

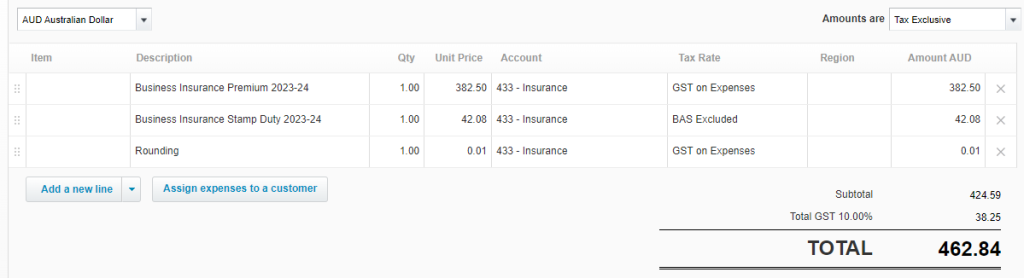

Enter a line in the bill for each charge shown on the bill. In this case, there is one for the premium and one for the stamp duty component. Select the insurance account you want to use – you may have one for business insurance and another for motor vehicle insurance etc. Notice that the premium figure is plus GST, whereas the stamp duty is BAS excluded. This is because stamp duty does not attract GST. It is very important to break up your insurance bill like this and to never enter a bill 100% inclusive of GST. Doing so will mean that you overclaim GST in your BAS.

Step 3

Check that the GST amount agrees with the insurance bill. In this case, it is $38.25 which is one cent less than our bill, hence the rounding line I have added to agree the total amount with the supplier’s bill.

Step 4

Approve the bill to ensure the expense is added to the accounts correctly.

Final Words…

So that’s it for this week’s “how-to”. I hope you learned something new. Please note that this insurance example is pretty basic. Some insurance bills have extra charges which may or may not include GST. The trick to getting these sorts of more complex bills entered correctly is to ensure the GST figure in the bill agrees with your software entry. If it doesn’t, you need to check each charge for its GST status i.e. some items will include GST and others may be GST-free or GST-exempt.

Next week I will show you how to enter motor vehicle registration bills. Until then, have a happy week.

Hi Thank you, but what happens if a client has multiple insurances from different insurances through a broker is financed and paid monthly, how do you show this monthly please.

Hi Michelle, great question! I would enter all of the insurance bills, including the financed amount and/or fees as one big bill in your software. The broker would be the supplier name and the bill would list multiple lines for each type of insurance. The financed amount and/or fees would also be included in this bill. The total should agree to the amount the broker has charged for all insurance expenses. Then each month when a payment is made for the insurance, apply the payment to this bill. To check if your figures are correct, simply divide the total by 12. The amount should agree to the monthly direct debit from the bank. Does that help?

Pingback: How to Series No 3 - How to Enter a Chattel Mortgage Asset Purchase & Loan — e-BAS Accounts